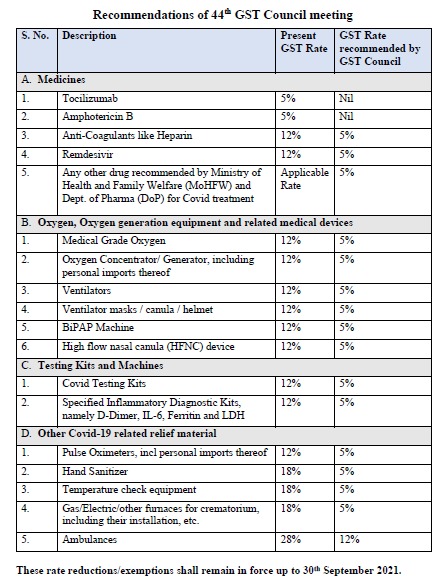

Shillong, June 12: The 44th GST Council on Saturday decided to reduce the GST rates on goods and materials being used in Covid-19 relief and management, bringing most items under the 5% bracket. The Council met under the Chairmanship of Union Finance Minister, Nirmala Sitharaman through video conferencing, which was also attended by Union Minister of State for Finance & Corporate Affairs, Anurag Thakur, Meghalaya Chief Minister Conrad K. Sangma and Finance Ministers of States and Union Territories and senior officers of the Ministry of Finance.

These new rates will remain in effect till 30th September, 2021.

Amphotericin B and Tocilizumab are the only drugs for which the GST has been waived; they were earlier under the 5% bracket. Remdesivir and anti-Coagulants like Heparin, which earlier had 12% GST, have been put under the 5% bracket. Any other drug recommended by the Ministry of Health and Family Welfare (MoHFW) and Dept. of Pharma (DoP) for Covid treatment will now attract 5 per cent GST.

Medical Grade Oxygen, oxygen concentrator/ generator including personal imports thereof, ventilators, ventilator masks/ canula/ helmet, BiPAP Machine, and High flow nasal canula (HFNC) device, Covid Testing Kits, specified Inflammatory Diagnostic Kits, namely D-Dimer, IL-6, Ferritin and LDH, pulse oximeters including personal imports thereof, all of which were under the 12% GST bracket will now attract 5% GST.

Materials that attracted 18% GST such as hand sanitizer, temperature check equipment, gas/electric/other furnaces for crematorium, including their installation, et al, will now attract 5% GST.

Ambulances, however, will attract 12% GST, which earlier had 28% GST.

Meghalaya CM’s role in GST rate slash

Meghalaya Chief Minister, Conrad K. Sangma had on 7 June, 2021 submitted the suggestions of the Group of Ministers (GoM) on GST concession and exemption on COVID relief materials to Union Finance Minister, Nirmala Sitharaman at New Delhi.

Just concluded the GST Council Meeting. Recommendations of the Group of Ministers (GoM) were presented to Hon’ble FM @nsitharaman Ji and all Hon’ble Members for their views and suggestions. pic.twitter.com/yzg6ot5cVh

— Conrad Sangma (@SangmaConrad) June 12, 2021

Ministry of Finance, Government of India had on May 29, 2021 constituted an eight-member inter-state Group of Minsters (GoM) headed by Conrad Sangma as its Convenor.

The other members of the group were, namely, Nitinbhai Patel – Deputy CM of Gujarat, Ajit Pawar – Deputy CM of Maharashtra, Mauvin Godinho – Minister of Transport and Panchayati Raj of Goa, K.N. Balagopal – Minister of Finance of Kerala, Niranjan Pujari – Minister of Finance and Excise of Odisha, T. Harish Rao – Minister of Finance of Telangana, and Suresh Kr. Khanna – Minister of Finance of Uttar Pradesh.

The GoM was tasked to examine the need for GST concession or exemption and make recommendations on COVID vaccines, drugs and medicines for COVID treatment, and testing kits for COVID detection; medical grade oxygen, pulse oximeters, hand sanitizers, oxygen therapy equipment such as concentrators, generators and ventilators, PPE kits, N95 masks, surgical masks, temperature checking equipment and any other items required for COVID relief.

The GoM had met on June 03, 2021 through video conference to discuss on the matter of GST concession/ exemption and made suggestions.