Mumbai, May 12: The Reserve Bank of India (RBI) has announced that 15 Non-Banking Financial Companies (NBFCs) have voluntarily surrendered their registration certificates. The list of NBFCs includes well-known names such as Tata Capital Financial Services and ABRN Finance.

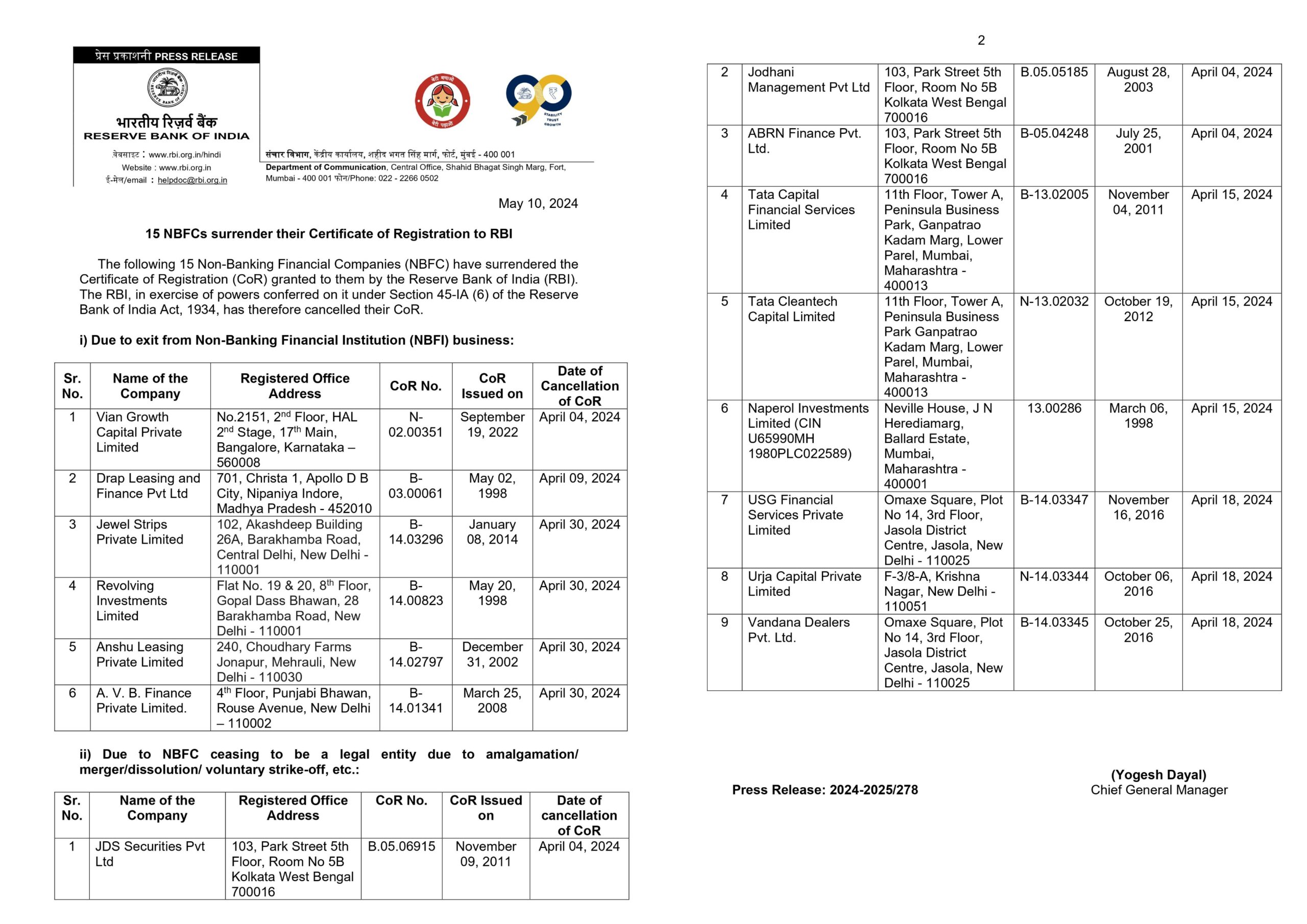

In an official press release, RBI announced that six Non-Banking Financial Companies (NBFCs) have voluntarily surrendered their Certificate of Registration (CoR) due to their exit from the Non-Banking Financial Institution (NBFI) business.

The companies include Vian Growth Capital Private Limited, Drap Leasing and Finance Pvt Ltd, Jewel Strips Private Limited, Revolving Investments Limited, Anshu Leasing Private Limited, and A. V. B. Finance Private Limited. The RBI has consequently cancelled their CoR under Section 45-IA (6) of the Reserve Bank of India Act, 1934.

Furthermore, nine NBFCs have ceased to be legal entities due to amalgamation, merger, dissolution, or voluntary strike-off, resulting in the cancellation of their CoR by the RBI. These companies are JDS Securities Pvt Ltd, Jodhani Management Pvt Ltd, ABRN Finance Pvt. Ltd., Tata Capital Financial Services Limited, Tata Cleantech Capital Limited, Naperol Investments Limited, USG Financial Services Private Limited, Urja Capital Private Limited, and Vandana Dealers Pvt. Ltd.

The cancellation of their CoR took effect between April 4, 2024, and April 18, 2024.

Notably, surrendering registration certificates means that these entities will no longer be able to conduct business as NBFCs. However, this decision does not impact any existing customer relationships or the validity of loan agreements.

The RBI regularly publishes the names of companies that surrender their registration certificates to keep the public informed about the status of financial institutions operating in the country.

According to financial experts, the reasons behind the surrender of registration certificates by Non-Banking Financial Companies (NBFCs) are diverse and varied.

In some cases, NBFCs may choose to surrender their registration certificates due to a complete exit from the Non-Banking Financial Institution (NBFI) sector. This could result from the company’s decision to focus on other business activities or to cease operations altogether.

Another reason for the surrender of registration certificates is the failure to meet regulatory requirements or maintain the required capital adequacy ratio. The Reserve Bank of India (RBI) may cancel the registration certificates of NBFCs that are unable to meet these requirements, leading to their surrender.

.

Additionally, some NBFCs may surrender their registration certificates for reasons such as amalgamation, merger, dissolution, or voluntary strike-off.

Also Read: Assam: Two APDCL Employees Held for Accepting Bribe in Nagaon

Also Watch

Find latest news from every corner of Northeast India at hubnetwork.in, your online source for breaking news, video coverage.

Also, Follow us on-

Twitter-twitter.com/nemediahub

Youtube channel- www.youtube.com/@NortheastMediaHub2020

Instagram- www.instagram.com/ne_media_hub