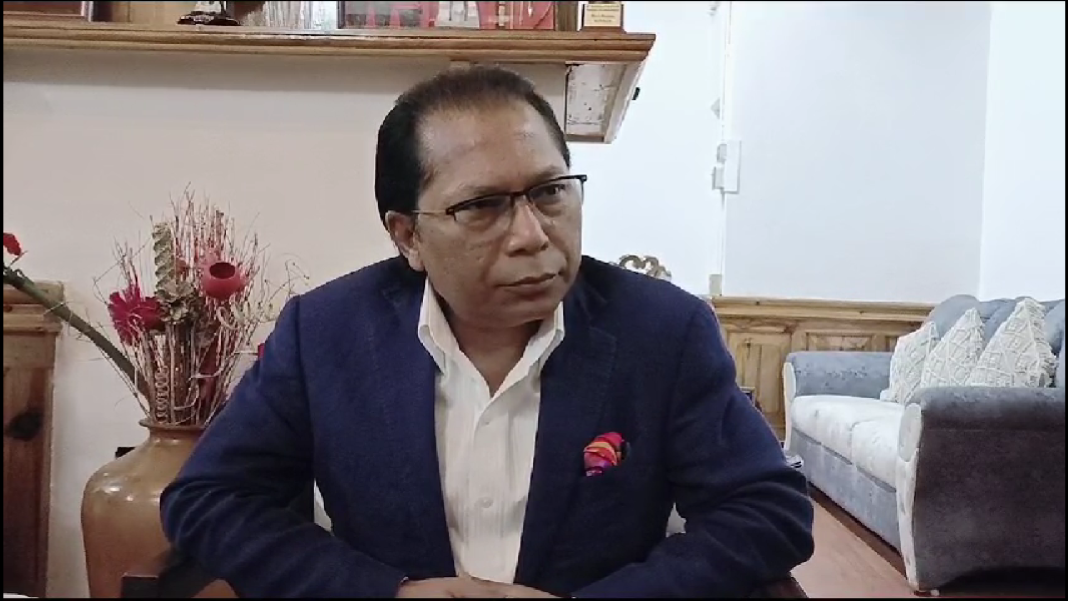

Shillong, Sept 10: Leader of Opposition Dr. Mukul Sangma has slammed the MDA government for increasing its borrowing limit to service the repayment of both principal and interest, which he warned will lead the state to a “disastrous future”.

Addressing the media, Sangma termed the government’s decision to increase the borrowing limit as a “red flag”.

“You (government) are further borrowing to service the repayment of principal and interest. This is where the concern lies and this is where the government is lying to the people…I condemn this attitude as this is going to lead the state to a disastrous future as has been honestly and truly reflected by the red flag given by the CAG. It is a red flag,” he said.

Taking loan to pay principal and interest

He also explained what is actually happening in the state by citing an example saying, “If you have borrowed from the bank, you have an EMI and now you cannot pay this EMI because your earning is not enough. Suppose you have to pay Rs 75000 and you are earning only 50000, how will you pay that Rs 75000 EMI, so you again borrow and you borrow to fund the borrowing and repayment of principal and interest”

“This is what is happening here. So borrowing and then borrowing to really repay both principal and interest by increasing the space of borrowing. That is why the CAG has in a nutshell, in a simpler and respectful term, indicated its concern. And the government of the day has the audacity to hide from the truth and be on denial mode. This is condemnable because we are all concerned about the future of the state and obviously, when you talk about the future of the state, you talk about fiscal health. You don’t expect your parents to borrow and borrow and leave behind the burden of debt upon you as children. That is not what sensible parents do. So running the government is the same,” Sangma added.

Stating that one cannot club this together with a soft loan provided by the government of India, the former chief minister said, “You may borrow from the government of India, which is considered as a soft loan where GOI gives you lots of space to manoeuvre keeping in mind the constraints of the state.”

Modus operandi to deviate from fiscal discipline

Further, Sangma alleged the government of adopting a well scripted modus operandi by deviating from the fiscal discipline.

“I caution the government, when they were coming up with this revised target in respect of the fiscal deficit target and the target set in respect of the debt GSDP ratio. This is an anomaly and it is a reflection of lack of sincerity, lack of sincerity to ensure fiscal discipline, that means there is a malafide intention from the very beginning. This is something which I have referred as in the past as a well scripted modus operandi. Now there are multiple illegalities and irregularities, whether it is in respect of coal mining, whether it is in respect of all their illegalities towards appointment for filling up the vacancies,” he said.

Emphasizing the need to adhere with provisions of the Meghalaya Fiscal Responsibility and Budget Management (MFRBM) Act, 2006, the TMC leader said, “There was amendment and government have created this provision to allow them to borrow more so they are saying it is allowed. But, I am telling you, government of India to a great extent have not examined it properly, that is why they piggy ride on the government of India sometimes but fiscal discipline is fiscal discipline.”

“The target in 2018-19 in respect of the fiscal deficit is 3.25% and what is the actual it is 6.3% – huge deviation. If you by 2019-20, it is 4.35, it has crossed 4 whereas during our time it was 3% and we never went beyond 3 in respect of the compliance that is required to be ensured by the government in sync with the MFRBM, 2006,” he said while adding “You will see the revenue target for 2021 is 5.25%. You cannot imagine from 3% you go to 4-5% – that is what I am referring to as modus operandi. Then you go down after completing the 5.25 target you go down to 4%. I have never seen that, it is not indicative of a set single target it is 4-4.5. Then in 2023, it is 4%.”

“When they have set the target of debt GSDP ratio at 28% for 2019, 2020, 2021, 2022 – the target set for achieving this debt GSDP ratio or otherwise the outstanding liabilities:GSDP ratio is fixed at the same target 28% but your fiscal deficit target is in variation. So this itself is reflective of a lack of comprehensive understanding and due diligence in respect of fiscal management,” he stated.

Watch

Find latest news from every corner of Northeast India at hubnetwork.in, your online source for breaking news, video coverage.

Also, Follow us on-

Twitter-twitter.com/nemediahub

Youtube channel- www.youtube.com/@NortheastMediaHub2020

Instagram- www.instagram.com/ne_media_hub

Download our app from playstore – Northeast Media Hub