Shillong, July 23: Union Finance Minister Nirmala Sitharaman on Tuesday presented the Union Budget 2024-25, wherein she proposed revised tax slab, made medicines and mobile phones cheaper, and stressed on skilling youth and enhancing employability.

This was her 7th consecutive Budget in Parliament.

Here are the major highlights of the Budget:

Budget Estimates 2024-25

– For the year 2024-25, the total receipts other than borrowings and the total expenditure are estimated at Rs. 32.07 lakh crore and Rs. 48.21 lakh crore, respectively.

– The net tax receipts are estimated at Rs. 25.83 lakh crore. The fiscal deficit is estimated at 4.9% of GDP

– The gross and net market borrowings through dated securities during 2024-25 are estimated at Rs. 14.01 lakh crore and Rs. 11.63 lakh crore respectively. Both will be less than that in 2023-24

– Aim to reach a deficit below 4.5 per cent next year.

Personal Income Tax: Revised Tax Slabs in New Tax Regime

– Standard Deduction for salaried employees to increase from Rs. 50,000 to Rs. 75,000.

– Deduction on Family Pension for Pensioners to Rise from Rs. 15,000 to Rs. 25,000.

– Revised tax slab (New Tax Regime):

₹0-3 Lakh: Nil

₹3-7 Lakh: 5%

₹7-10 Lakh: 10%

₹10-12 Lakh: 15%

₹12-15 Lakh: 20%

Above ₹15 Lakh: 30%

Tax reduced for businesses

– Two tax exemption regimes for charities to be merged into one

– TDS rate on e-commerce to be reduced from 1% to 0.1%.

– Decriminalization of TDS delay up to the filing of tax date

– Angel tax for all classes of investors to be abolished

– Unlisted bonds, debentures, debt mutual funds, market-linked debentures to be taxed at slab rate

– Corporate tax rate on foreign companies to be reduced to 35%

– Simpler tax regime for foreign shipping companies operating domestic cruises in the country

Mobile phones, gold and silver to be cheaper

– Customs duty on 3 more medicines to be fully removed, to provide relief to cancer patients

– Basic customs duty on mobile phone, mobile PCBA and mobile charger to be reduced to 15%

– 25 critical minerals to be exempted from customs duties & BCD on two of them to be reduced

– Customs duties on gold and silver reduced to 6% and 6.5% on platinum

More benefits for farming sector

– Rs. 1.52 lakh crore allotted for agriculture & allied sectors

– Financial support for setting up a network of Nucleus Breeding Centres for Shrimp Broodstocks to be provided

– New 109 high yielding & climate resilient varieties of 32 field and horticulture crops to be released for cultivation by farmers

– Higher Minimum Support Prices announced for all major crops.

– PM Gareeb Kalyan Anna Yojana extended for 5 years benefitting more than 80 crore people

– 1 crore farmers to be initiated into natural farming over 2 years

Solar Panel Scheme

– Free electricity of up to 300 units per month for 1 crore households under Solar Panel Scheme

PM Janjatiya Unnat Gram Abhiyan for Tribals

– To be launched to improve the socio-economic conditions of India’s tribal communities

– To cover 63,000 villages and benefit 5 crore tribal people.

Tourism Boost

– Vishnupad Temple Corridor & Mahabodhi Temple Corridor to be transformed into world class pilgrim & tourist destinations

– Rajgir to be comprehensively developed

– Nalanda to be developed as a tourist Centre; Nalanda University to be revived to its glorious stature

– Support for Odisha tourism

Infrastructure

– Capital expenditure to be Rs. 11,11,111 crore @ 3.4% of GDP

– Provision of Rs. 1.5 lakh crore for long-term interest-free loans to support Infrastructure investment by state governments

– Industrial node at Gaya on Amritsar Kolkata Industrial Corridor to be developed

– Road connectivity projects to be developed at the cost of Rs. 26,000 Cr

Youth Skilling & Development

– 20 lakh youth will be skilled over a 5 year period

– 1000 ITIs will be upgraded in Hub and Spoke arrangements with outcome orientation

– Internships at 500 top companies to be promoted, with Rs. 5,000 allowance and Rs. 6,000 one-time assistance to be provided

Urban & Rural Development

– 14 large cities with a population above 30 lakh will have Transit Oriented Development plans

– 1 cr urban poor and middle-class families to be covered under PM Awas Yojana Urban 2.0

– 100 weekly ‘haats’ or street food hubs in select cities

– Rs. 2.66 lakh crore allocated for rural development

Industry

– Investment-ready “plug and play” industrial parks to be developed in or near 100 cities

– 12 industrial parks sanctioned under National Industrial Corridor Development Programme

Flood Relief for Assam

– Government to assist Assam with flood management and irrigation projects

– Rs. 11500 crores for flood management in Assam

– Flood relief help to Sikkim and Uttarakhand as well

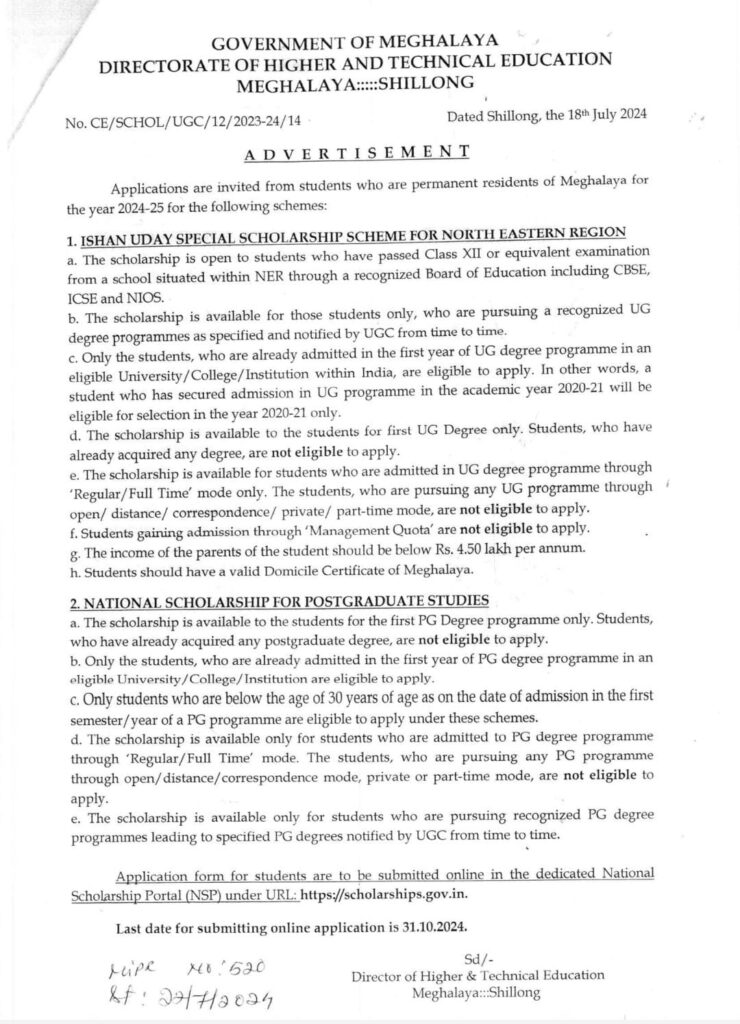

Education

– Financial support for loans up to Rs. 10 lakh in higher education in domestic institutions

India post

– India post payment banks to be expanded in North East; More than 100 branches of India Post Payment Bank to be set up in the North East region.

Read: Stand-off between factory owner and HYC over document checks

WATCH:

Find latest news from every corner of Northeast India at hubnetwork.in, your online source for breaking news, video coverage.

Also, Follow us on-

Twitter-twitter.com/nemediahub

Youtube channel- www.youtube.com/@NortheastMediaHub2020

Instagram- www.instagram.com/ne_media_hub