Shillong, July 23: Union Finance Minister Nirmala Sitharaman is presenting her 7th consecutive Budget in Parliament on Tuesday. The Budget 2024-25, seen as a roadmap for the next 5 years for Modi 3.0 government, is expected to announce an increase in the basic exemption limits under both old and new tax regimes in a huge relief for the middle class.

Updates below:

Farmers’ and Agriculture

– Government to facilitate implementation of Digital Public Infrastructure (DPI) in agriculture, in partnership with the states

– Financial support for setting up a network of Nucleus Breeding Centres for Shrimp Broodstocks to be provided

– Rs. 1.52 lakh crore allotted for agriculture & allied sectors

– New 109 high yielding & climate resilient varieties of 32 field and horticulture crops to be released for cultivation by farmers

– For farmers, the govt. announced higher Minimum Support Prices for all major crops.

– PM Gareeb Kalyan Anna Yojana was extended for 5 years benefitting more than 80 crore people

Solar Panel Scheme

– Free electricity of up to 300 units per month for 1 crore households under Solar Panel Scheme

Land-related Reforms and Actions

– Reforms in land administration, urban planning, usage and building bylaws in both rural and urban areas

– All lands in rural areas to be assigned Unique Land Parcel Identification Number

– Land registry to be established in rural areas

PM Janjatiya Unnat Gram Abhiyan

– to be launched to improve the socio-economic conditions of India’s tribal communities

– To cover 63,000 villages and benefit 5 crore tribal people.

Labour Reforms

– e-shram portal to be integrated with other portals to provide one-stop labour services solution

– Will include mechanism to connect job-seekers with potential employers and skill providers

NPS for Minors

– NPS-Vatsalya, a plan for contribution by parents and guardians for minors, to be launched

– Plan can be seamlessly converted into a normal NPS account on minor becoming an adult

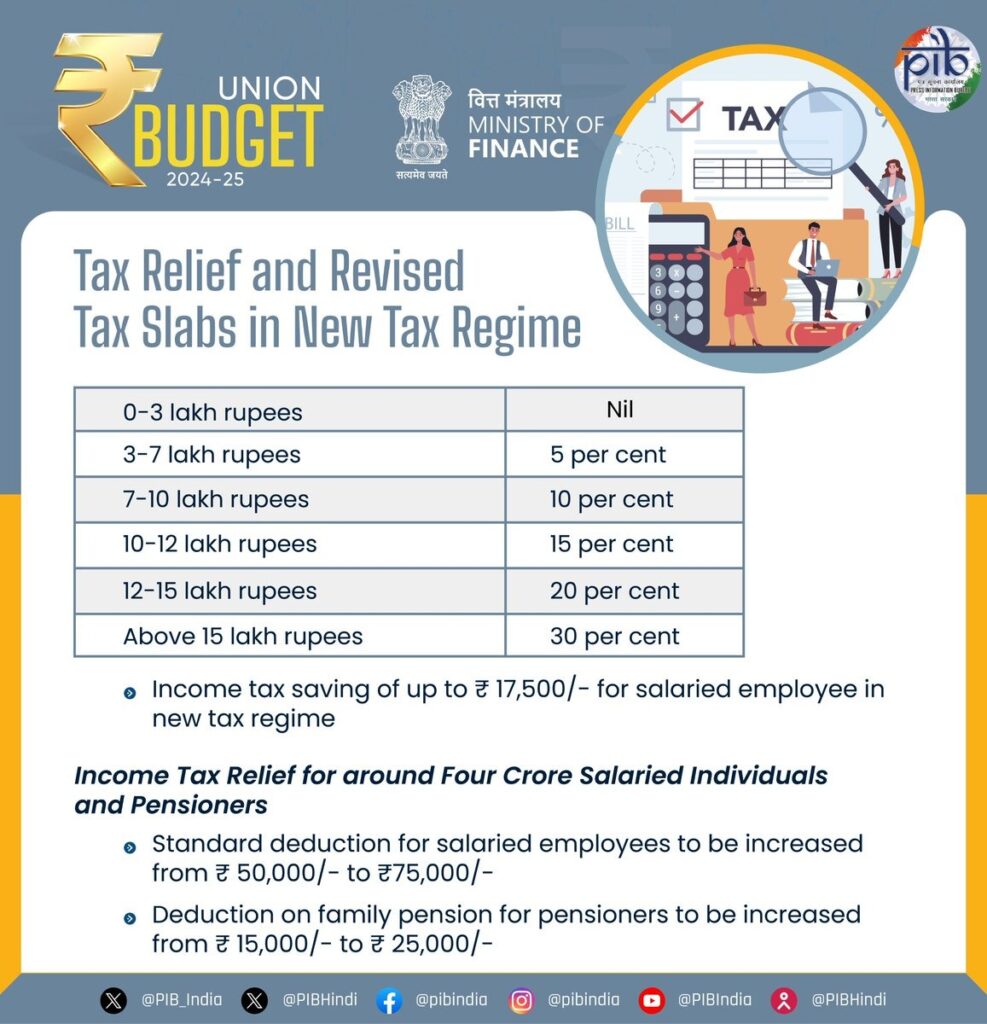

Personal Income Tax: Revised Tax Slabs in New Tax Regime

– Standard Deduction for salaried employees to increase from Rs. 50,000 to Rs. 75,000.

– Deduction on Family Pension for Pensioners to Rise from Rs. 15,000 to Rs. 25,000.

– Income tax saving of up to Rs. 17,500 for salaried employee in new tax regime

– Revised tax slab (New Tax Regime):

₹0-3 Lakh: Nil

₹3-7 Lakh: 5%

₹7-10 Lakh: 10%

₹10-12 Lakh: 15%

₹12-15 Lakh: 20%

Above ₹15 Lakh: 30%

Major announcements for Income Tax

– Two tax exemption regimes for charities to be merged into one

– TDS rate on e-commerce to be reduced from 1% to 0.1%.

– Decriminalization of TDS delay up to the filing of tax date

– Angel tax for all classes of investors to be abolished

– Unlisted bonds, debentures, debt mutual funds, market-linked debentures to be taxed at slab rate

– Corporate tax rate on foreign companies to be reduced to 35%

– Simpler tax regime for foreign shipping companies operating domestic cruises in the country

Simplification of IT Act, Tax Reassessment, Capital Gains Taxation

– Income Tax Act, 1961 to be made concise and easy to read

– Opening of Reassessment beyond 3 years from end of assessment year only if escaped income is Rs. 50 lakh or more, up to a maximum period of 5 years from end of assessment year

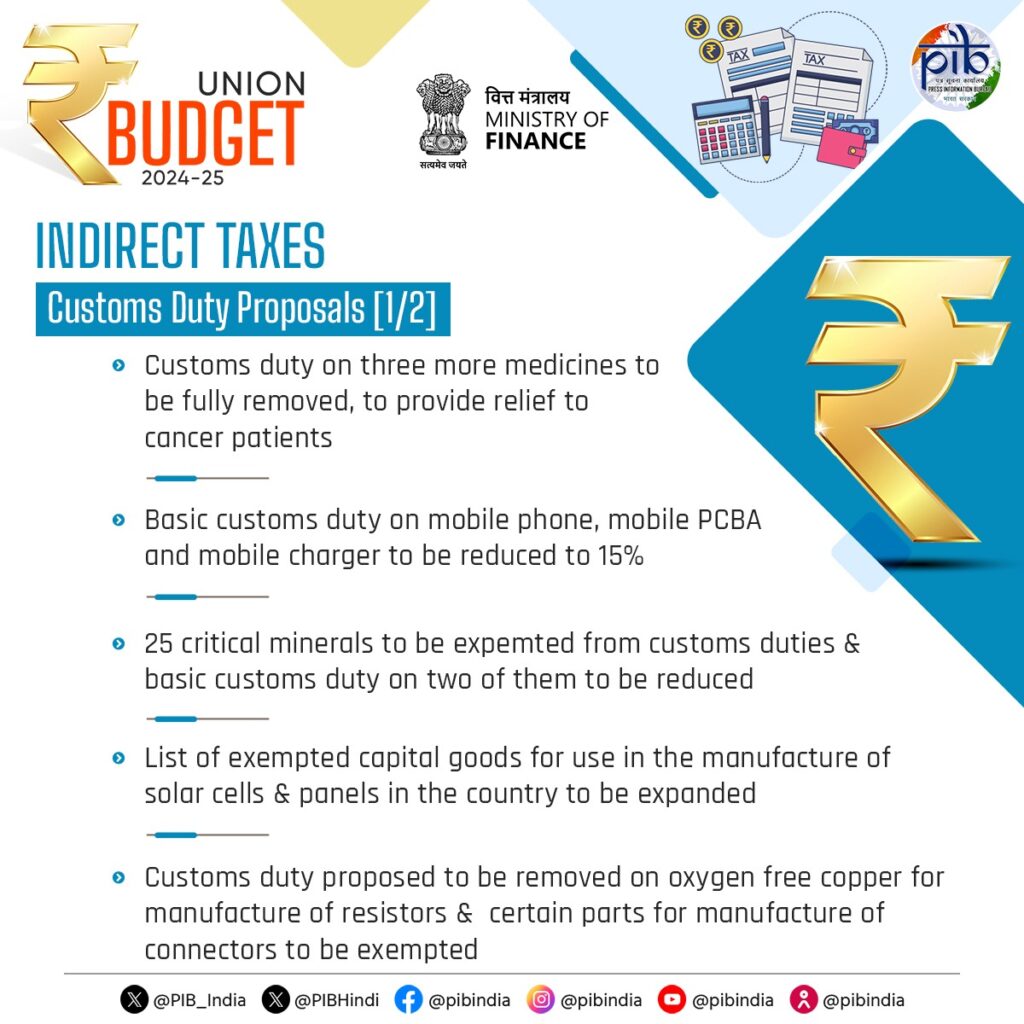

Customs Duty Proposals: Mobile phones, cancer medicines to be cheaper

– Customs duty on 3 more medicines to be fully removed, to provide relief to cancer patients

– Basic customs duty on mobile phone, mobile PCBA and mobile charger to be reduced to 15%

– 25 critical minerals to be exempted from customs duties & BCD on two of them to be reduced

– Customs duties on gold and silver reduced to 6% and 6.5% on platinum

Tourism

– Vishnupad Temple Corridor & Mahabodhi Temple Corridor to be transformed into world class pilgrim & tourist destinations

– Rajgir to be comprehensively developed

– Nalanda to be developed as a tourist Centre; Nalanda University to be revived to its glorious stature

– Support for Odisha tourism which has scenic beauty, temples, craftsmanship, natural landscapes, wildlife sanctuaries and pristine beaches

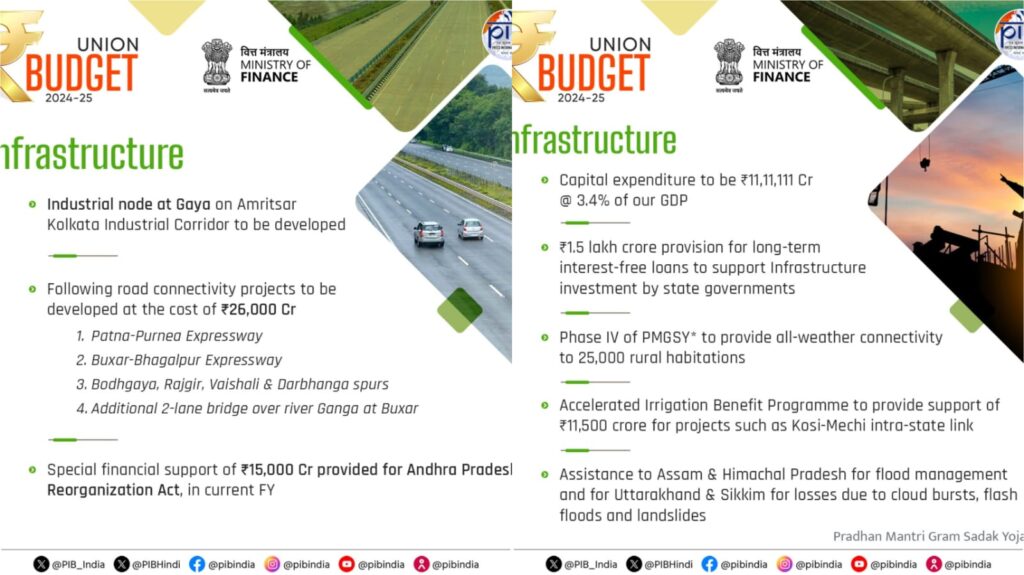

Infrastructure

– Government’s endeavour to maintain strong fiscal support for infrastructure over the next 5 years

– Capital expenditure to be Rs. 11,11,111 crore @ 3.4% of GDP

– Provision of Rs. 1.5 lakh crore for long-term interest-free loans to support Infrastructure investment by state governments

– Industrial node at Gaya on Amritsar Kolkata Industrial Corridor to be developed

– Road connectivity projects to be developed at the cost of Rs. 26,000 Cr

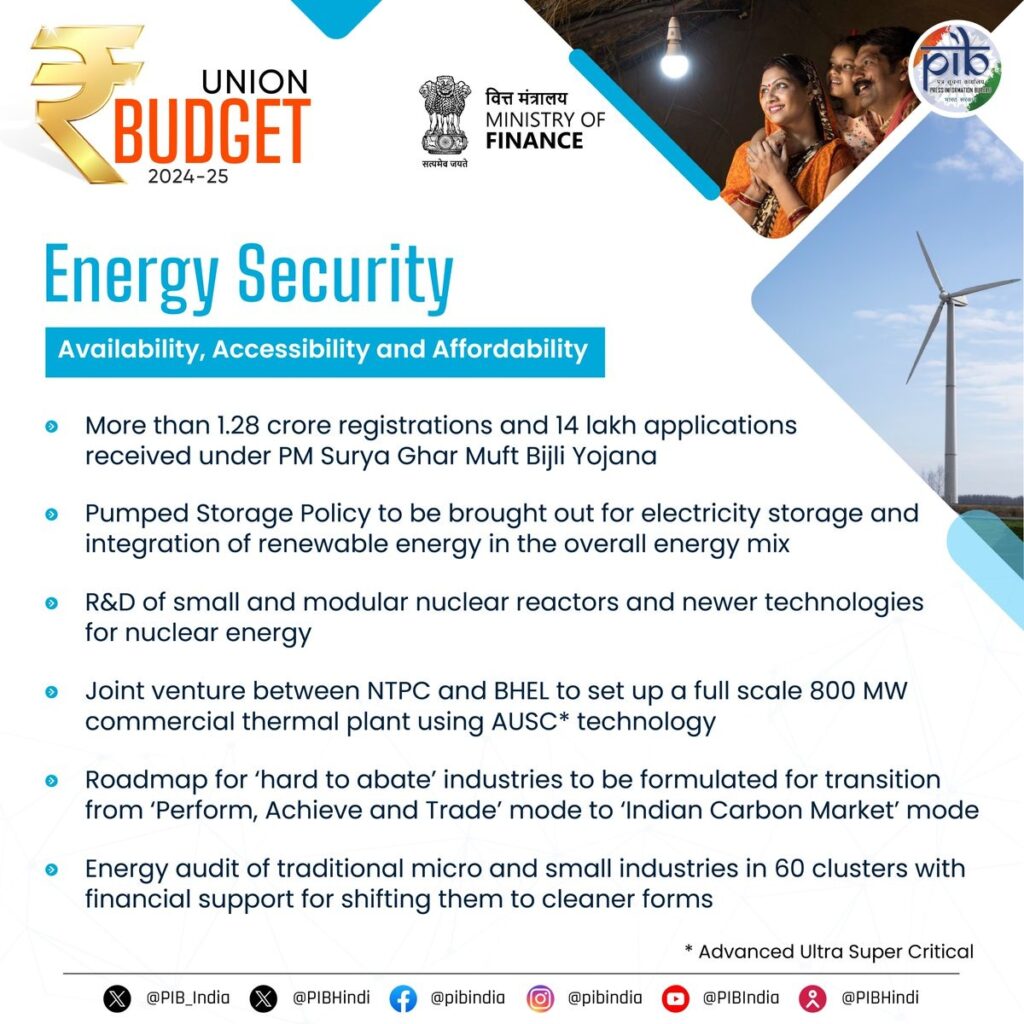

Energy Security

– More than 1.28 crore registrations and 14 lakh applications received under PM Surya Ghar Muft Bijli Yojana

– Pumped Storage Policy to be brought out for electricity storage and smooth integration of renewable energy in the overall energy mix

– Joint venture between NTPC and BHEL to set up a full scale 800 MW commercial thermal plant using AUSC technology

Skill Development

– Direct benefit transfer of one month’s salary in three installments to first-time employees as registered in EPFO, will be up to Rs. 15,000.

– The eligibility limit will be a salary of Rs. 1 Lakh per month.

– The scheme is expected to benefit 210 Lakh youth

– 20 lakh youth will be skilled over a 5 year period

– 1000 ITIs will be upgraded in Hub and Spoke arrangements with outcome orientation

– The Model Skill Loan scheme will be revised to facilitate loans up to Rs. 7.5 lakh with a guarantee from government promoted fund

Urban Development

– 14 large cities with a population above 30 lakh will have Transit Oriented Development plans

– 1 cr urban poor and middle-class families to be covered under PM Awas Yojana Urban 2.0

– 100 weekly ‘haats’ or street food hubs in select cities

– Direct benefit transfer of one month’s salary in three installments to first-time employees as registered in EPFO, will be up to Rs. 15,000.

– The eligibility limit will be a salary of Rs. 1 Lakh per month.

– The scheme is expected to benefit 210 Lakh youth

IBC & Tribunals

– Integrated technology platform to be set up for improving the outcomes under Insolvency & Bankruptcy Code

– Services of Centre for Processing Accelerated Corporate Exit to be extended for voluntary closure of LLPs

– Debt recovery tribunals to be strengthened & additional tribunals to be established to speed up recovery

– Prime Minister’s Package for employment & Skilling: 3 schemes announced for ‘Employment Linked Incentive’: Scheme A: First Timers; Scheme B: Job Creation in Manufacturing ; Scheme C: Support to Employers

Industry

– Investment-ready “plug and play” industrial parks to be developed in or near 100 cities

– 12 industrial parks sanctioned under National Industrial Corridor Development Programme

Major announcement on Floods

– Government to assist Assam with flood management and irrigation projects

– Rs. 11,500 crores for flood management in Assam

– Flood relief help to Sikkim and Uttarakhand as well

MSMEs

– Credit guarantee scheme for in manufacturing to be introduced

– Up to Rs 10 lakh in higher education loans for colleges across India

– 3 crore additional homes to be constructed in rural and urban areas

– Rs 3 lakh crore allocated for schemes benefiting women and girls

– Rs. 2.66 lakh crore allocated for rural development

More announcements:

- Mudra loan limit increased to Rs. 20 Lakh from Rs. 10 Lakh

- Internships at 500 top companies to be promoted, with Rs. 5,000 allowance and Rs. 6,000 one-time assistance provided

- Rental housing with dormitory-style accommodation for industrial workers to be developed through PPP model with VGF support

- India post payment banks to be expanded in North East

- More than 100 branches of India Post Payment Bank to be set up in the North East region

- 1 crore farmers to be initiated into natural farming over 2 years

- Scheme for first timers: Government will provide 1 month wage to all people newly entering workforce in all sectors

- 10,000 need-based bio-input resource centers will be established

- To achieve Aatmanirbharta in pulses & oil seeds, their production, storage, and, marketing will be strengthenen

- Incentive to be provided at specified scale both to employee, employer in first four years of employment

- Rs 15,000 crore to be arranged for Andhra Pradesh in FY25 for development of its capital

- Four expressway and bridge projects worth ₹ 26,000 crores

- Model skill loan scheme to be revised to facilitate loans up to ₹ 7.5 lakh with guarantee from government-promoted fund

- For Irrigation and Flood Mitigation in Bihar, through the Accelerated Irrigation Benefit Programme and other sources, government will provide financial support for projects with estimated cost of ₹11,500 crore such as the Kosi-Mechi intra-state link and 20 other ongoing and new schemes including barrages, river pollution abatement and irrigation projects.

- Budget to focus on employment, skilling, MSMEs, middle class

- India’s inflation continues to be low, stable, moving towards 4% target

- Focus On 9 Priorities: Productivity and resilience in agriculture; Employment and skilling; Improved human resources, social justice; Manufacturing and services; Urban development; Energy security; Infrastructure; Innovation, research and development; Next generation reforms.